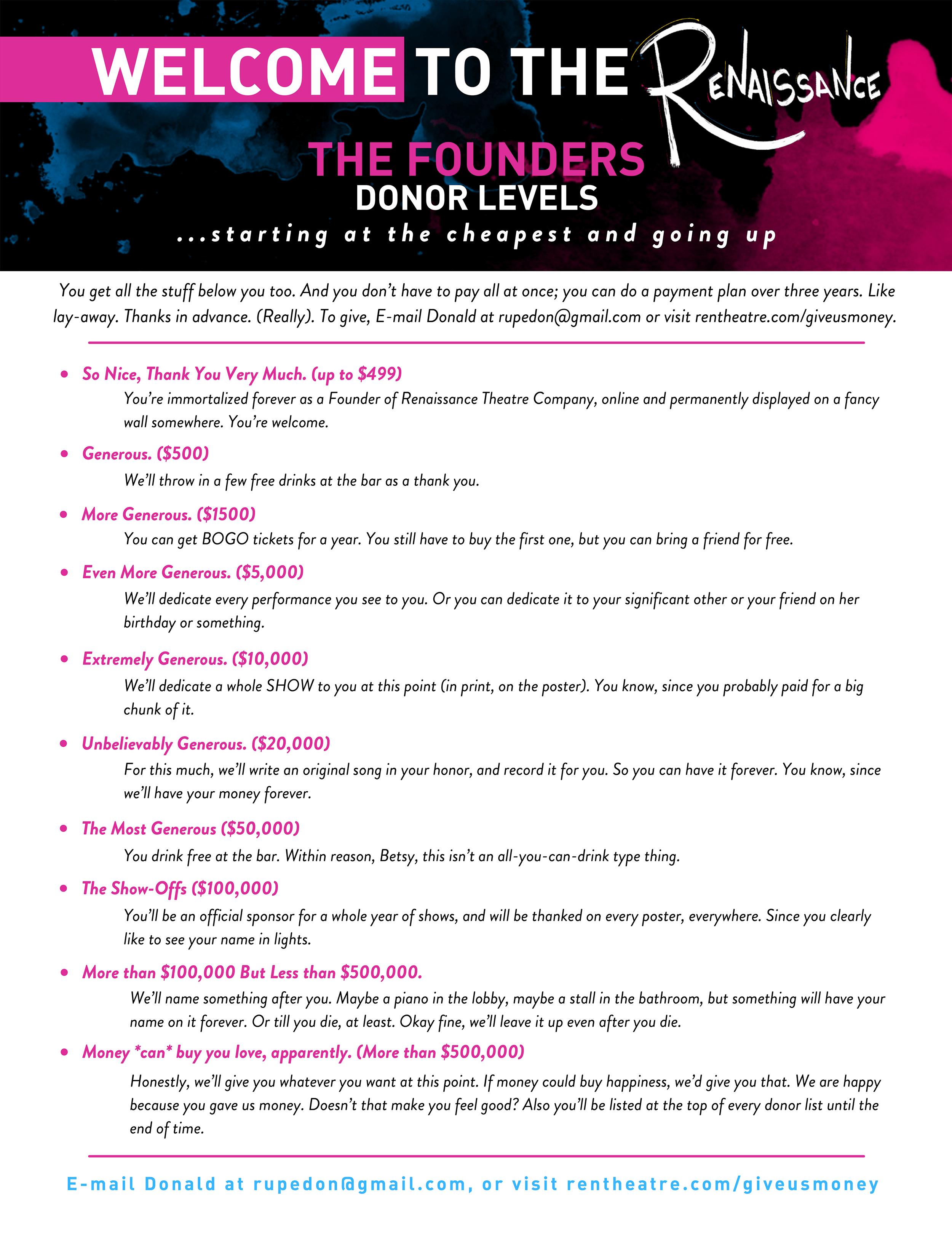

Raise $600,000 in 2026

from Individual Donors, Corporate Sponsors, and Grants!

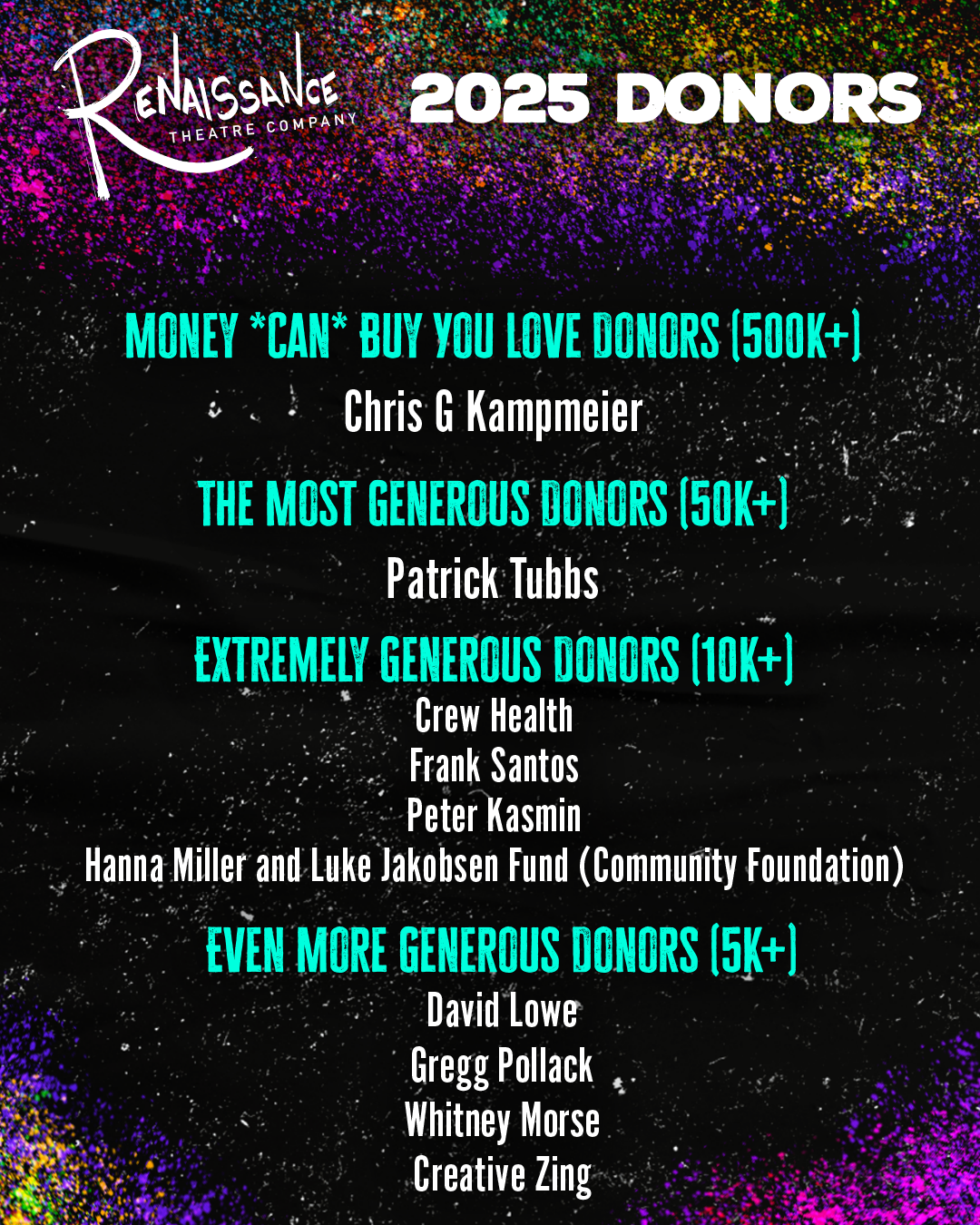

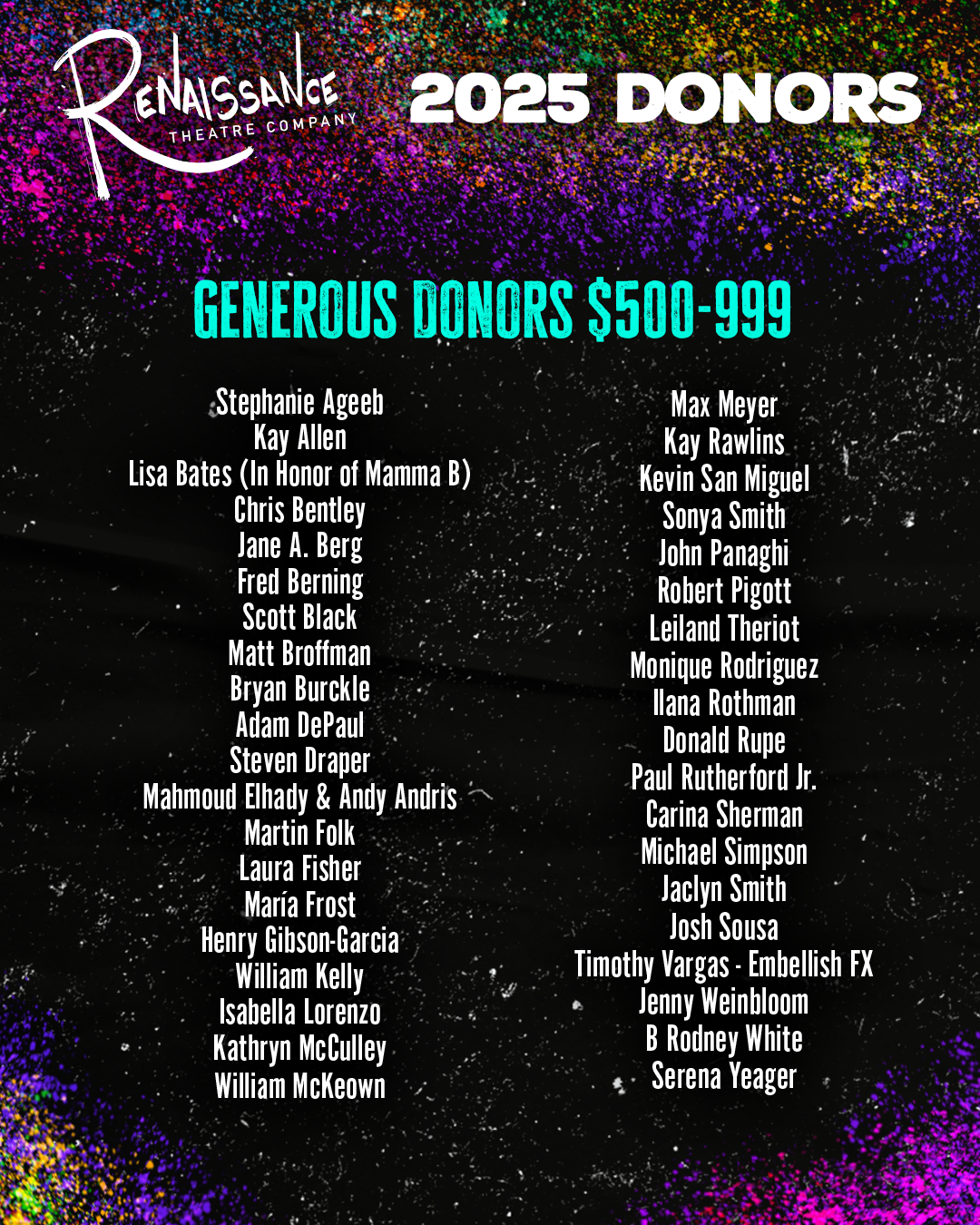

Thank You to those who have already given to the Ren:

*NEW! SEASON PASSES*

Introducing

Friends with Benefits!

Ever wanted a season pass to all Ren events?

Now’s your chance to become a Friend with Benefits at the Ren! A subscription service that gives you access to all of our shows and parties in exchange for our monthly donation. Read through all of our tier options and become a friend with bennies today!

How to Donate

There are so many ways to support brand-new art, wonderfully-talented artists, and the budding Renaissance of Culture in your backyard. Choose below!

1. Give ONLINE! (with Credit Cards or Apple Pay!)

It's super easy to donate online using a credit or debit card.

p.s. If you have Apple Pay, try it out. You don't have to type anything in, so it's instant. It's magical.

2. Send a check!

The only downside of credit cards for us is that there's always a processing fee, which really adds up for big amounts. If you can, mail us a check. It's free! Except the stamp I guess.

Make your check out to Renaissance Theatre Company and put it in the mail to:

Donald Rupe

Renaissance Theatre Company

415 E Princeton St

Orlando, FL 32803

If you don't have checks, you can usually do this with your online banking's bill pay, and then you don't even have to pay for the stamp. They'll print it and mail it to us for free.

3. Become one of our all-star recurring donors!

Direct deposits are an automatic, secure way to make a one-time or recurring gift without the higher fees from processing credit cards. We have a whole web page about ACH here with a form you can fill out to get started. Click that!

Corporate Sponsors

We also take money (and things!) from other businesses. We’ll put your logo on things and encourage people to patronize you (after they patronize us, of course). You can sponsor a show, or a season, or whatever, depending on how much you give us.

Thanks to our Corporate Sponsors/Partners so far

This programming is supported by United Arts of Central Florida, funded in part by the

Orange County Government through the Arts & Cultural Affairs Program

Still scrolling? You non-profit/tax geeks can find all the information you need on our handy "About Us" page. Get our EIN, non-profit filings, and more!

(If you need our EIN, it's 86-2197367. Saved you a click.)

📠 Taxes FAQses 📠

Are donations tax-deductible?

🥳 Renaissance Theatre Company, Inc. is a full "501(c)(3)" public charity and donors can deduct contributions made directly to us to the extent allowed by law. The IRS issued our "determination letter" right on schedule, around our second birthday as a company. The structure of an efficient non-profit takes some time to set up, so the law lets new companies operate under non-profit rules for up to 27 months from founding (February 18, 2021, for us) while one puts everything in its right place. They have the same rule for donations, which become retroactively tax-deductible once our exempt status is recognized. So yes, any donation since that date and henceforth is qualified to be deductible. Go hence, go forth, and give us Money, Please!

I donated to Renaissance Theatre Company in 2021 or 2022, but when I did my taxes for those years, I didn't claim the donations on my Forms 1040. What do I do?

First, excellent pluralization there, just top-notch. Second, consult your local accountant and/or tax lawyer. There might be one in your cupboard. Because we really can't provide tax advice. Just between unqualified friends, though, and assuming the donation otherwise qualifies to be tax-deductible, AND your tax situation allowed you to claim the deduction on your Form 1040, third, you can file an amendment for each year this happened and get a check in the mail if you’re owed money.

I donated in 2021 or 2022, and when I calculated my taxes for those years, I DID include it in my calculations because I figured y’all would probably be fine. What do I do?

Again, consult an expert. In theory, that tiny part of your taxes is retroactively correct, but they can check and make sure about all the other parts you probably got wrong.

Finally, because we asked you for Money, Please! Again higher up on this web page, it’s our duty to tell you that our Florida Department of Agriculture & Consumer Services Registration Number is CH66046, and that

A COPY OF THE OFFICIAL REGISTRATION AND FINANCIAL INFORMATION MAY BE OBTAINED FROM THE DIVISION OF CONSUMER SERVICES BY CALLING TOLL-FREE (800-435-7352) WITHIN THE STATE. REGISTRATION DOES NOT IMPLY ENDORSEMENT, APPROVAL, OR RECOMMENDATION BY THE STATE.

So there.